On 22 January 2019, BGL BNP Paribas, Cardif Lux Vie and the Luxembourg Tennis Federation (FLT – Fédération Luxembourgeoise du Tennis) signed a two-year extension to their partnership in the presence of Geoffroy Bazin, Country Head of the BNP Paribas Group and Chairman of the BGL BNP Paribas Executive Committee; Thierry Schuman, member of the BGL BNP Paribas Executive Committee; Charles Degen, member of the Cardif Lux Vie Executive Committee; Claude Lamberty, Chairman of the Luxembourg Tennis Federation; and Markus Stegmann, treasurer of the Luxembourg Tennis Federation.

“We are delighted to reaffirm our support for the Luxembourg Tennis Federation. This partnership, which began four years ago, fully reflects the fair play values that are dear to Cardif Lux Vie, and underlines our company’s growing involvement in developing the country’s sport landscape, said Charles Degen.

Claude Lamberty added, “We are especially pleased to be renewing our partnership with BGL BNP Paribas and Cardif Lux Vie, whose loyalty towards the Luxembourg Tennis Federation is a magnificent statement of trust.”

On signing the deal, Geoffroy Bazin pointed out that “BGL BNP Paribas has been supporting tennis in Luxembourg for many years. As a responsible company, our bank wishes to play an active role in the country’s social, cultural and sporting life. The renewal of this partnership until the end of 2020 is just one of many initiatives undertaken by the BNP Paribas Group in Luxembourg to uphold its commitment and role in society. This sponsorship also reflects the BNP Paribas Group’s long-standing involvement as the number-one world-class tennis sponsor”.

About Fédération Luxembourgeoise de Tennis (FLT)

The FLT’s goal is to promote, organise and develop tennis in Luxembourg, including club tennis, teaching and training, as well as individual and team competition.

The Federation also represents Luxembourg by sending teams to international events (Davis Cup, Fed Cup, Olympics, etc.) and organising ITF tournaments.

The FLT in figures: 51 clubs / 260 courts / 4,750 A licence holders / 16,000 active players.

From 22 to 23 October 2018, the 17th EBAN Winter Summit brought together a community of highly dedicated investors and entrepreneurs at BGL BNP Paribas’ offices in Luxembourg-Kirchberg.

The EBAN Winter Summit is one of the two main annual events of the European Business Angel Network (EBAN) and highlights the most important issues and best practices in the early stage investment sector. Under the theme “Better Together: How to shape a more sustainable and innovative world”, the 2018 edition brought together some 50 renowned speakers and more than 400 attendees from all over the world to participate in the many mentoring sessions, workshops and conferences on offer.

“BGL BNP Paribas is extremely proud to host the 17th edition of this leading international event. I am convinced that innovation and sustainable development go hand in hand,” said Geoffroy Bazin, Country Head of the BNP Paribas Group and Chairman of the BGL BNP Paribas Executive Committee.

The event was co-hosted by Lux Future Lab (founded by BGL BNP Paribas), EBAN, LBAN (Luxembourg Business Angel Network) and the EIPP (European Investment Project Portal) of the European Commission, with the support of the Luxembourg Ministry of the Economy as well as EY (gold sponsor) and Arendt (silver sponsor).

EBAN is the pan-European representative of business angels and comprises more than 150 member organisations in over 50 countries. The organisation represents a sector whose investment is estimated at EUR 7.5 billion per year, thus playing an essential role in Europe’s future, especially in the financing of young innovative enterprises.

Further information is available on the websites www.eban-luxembourg-2018.com and www.eban.org.

The employees of the BNP Paribas Group in Luxembourg run for a good cause

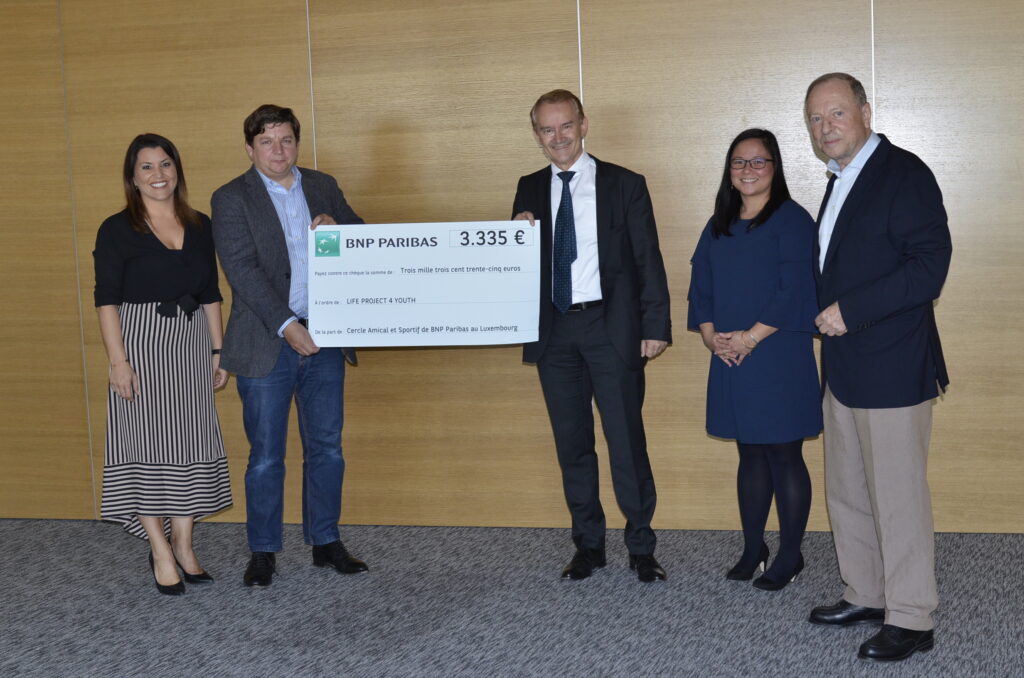

During a ceremony organised on 3 October 2018, Marc Lenert, a member of the Executive Committee of BGL BNP Paribas and Chairman of the Cercle Amical et Sportif (C.A.S.) of BNP Paribas in Luxembourg, and Christine Donati, Chairwoman of the C.A.S. Running Section, presented a cheque for EUR 3,335 to Jean-Marie Demeure, vice chairman of the Life Project 4 Youth (LP4Y) Luxembourg.

The cheque was presented after almost 70 employees of the BNP Paribas Group in Luxembourg participated in the Luxembourg Night Marathon on 12 May 2018. To support them in their efforts, the management of the BNP Paribas Group in Luxembourg had committed to make a donation proportional to the number of runners crossing the finish line. For the 13th year running, the involvement of the Group’s employees in Luxembourg has helped support a charitable organisation.

This year, the funds raised will be used to support the charity Life Project 4 Youth Luxembourg in its daily activities to promote Youth inclusion through entrepreneurship in the Philippines, Vietnam, India and Indonesia. At the cheque handover ceremony, Jean-Marie Demeure expressed his gratitude for the shared commitment to the work of LP4Y Luxembourg.

Marc Lenert took the opportunity to thank the employees of BNP Paribas Group in Luxembourg who took part in the 2018 edition of the ING Night Marathon: “I would like to congratulate all employees who, by taking part in the marathon, have done their bit for a good cause and helped us raise this money for Life Project 4 Youth Luxembourg. We aim to be socially responsible and are committed to helping the community. By combining sport and social engagement, this initiative is a true reflection of our Group’s values.”

The BNP Paribas Group in Luxembourg supports 26 new community projects with total funding of EUR 68,500

On 3 October 2018, the cheque for the 9th annual HELP2HELP programme was presented in a ceremony at BGL BNP Paribas’ headquarters, in the presence of Geoffroy Bazin, Country Head of the BNP Paribas Group and Chairman of the BGL BNP Paribas Executive Committee, and members of the organisations funded.

The HELP2HELP programme, formerly named “Coup de Pouce”, aims to encourage current and retired employees of the BNP Paribas Group in Luxembourg to become involved in the community activities of not-for-profit organisations. In 2018, 26 projects supported by 28 employees and retirees were selected to receive total funding of EUR 68,500. The projects are led both at local and international level in fields including humanitarian aid, education, disabilities, healthcare, solidarity, and the fight against insecurity. Since 2010, a total of over EUR 650,000 in support has been awarded to more than 220 projects.

Besides financial support through the HELP2HELP programme, the organisations can also take part in the “Marché de Noël des Associations”, a Christmas market held each year at BGL BNP Paribas’ headquarters. From 3 to 6 December 2018, they will be able to present their activities to the employees of the BNP Paribas Group in Luxembourg while offering them the chance to contribute to a good cause by doing some of their Christmas shopping at the same time.

“We are delighted to see how popular our HELP2HELP initiative is year after year. This indicates the exceptional voluntary commitment of current and retired staff of the BNP Paribas Group in Luxembourg. This commitment is also one of our Group’s values and it is encouraging to see that so many of our staff members are personally involved in civil society”, stated Geoffroy Bazin.

First half of 2018 characterised by growth in commercial activities

- Net banking income was EUR 693.1 million, up 6%

- Retail and Corporate Banking Luxembourg recorded significant 13% growth in average deposits and 9% growth in average loan outstanding compared with the first half of 2017.

- Wealth Management reported strong activity, with 8% growth in assets under management and 7% growth in average loan outstanding.

- Leasing International continued to expand its business in line with its strategy, with average loan outstanding up 16%.

- Overheads of EUR 375.2 million

- Overheads remain controlled at constant perimeter. The bank continues to invest in strategic projects dedicated to commercial development and the provision of digital solutions.

- Group consolidated net profit excluding minority interests came to EUR 131.2 million

- High solvency maintained

- Own funds amounted to EUR 6.1 billion.

- The solvency ratio reached 23.5% (under Basel III rules), well above the regulatory minimum.

- Closing of the acquisition of ABN AMRO (Luxembourg) S.A.

- Following the approval by the competent regulatory authorities, the transaction was completed on 3 September 2018. It represents EUR 5.6 billion in assets under management for the Wealth Management activity.

- Best Bank in Luxembourg

- Euromoney named BGL BNP Paribas Best Bank in Luxembourg for the third consecutive year.

On 6 September 2018, the bank’s Board of Directors examined the consolidated financial statements of BGL BNP Paribas under IFRS at 30 June 2018.

Net banking income reached EUR 693.1 million, up 6% on the first half of 2017. In an environment of persistently low rates, commercial activity remains very strong in the various business areas.

Thanks to the favourable economic conditions in Luxembourg and strong commercial activities, Retail and Corporate Banking recorded growth in average loan outstanding of 9%, boosted by an increase in mortgages and investment loans. Average deposit volumes grew by 13%, largely due to excellent inflows from corporate clients associated with the development of international cash management services.

Compared with the previous year, Wealth Management posted growth of 8% in assets under management. All segments are showing improvement in terms of net capital inflows. Thanks to a flexible, bespoke range of financing solutions, Wealth Management’s average loan outstanding grew by 7%.

The bank took advantage of its status as a member of the international BNP Paribas Group to offer a comprehensive range of products and services to its institutional investor clients through its Corporate and Institutional Banking business line. The business line continues to perform in line with objectives.

Leasing International’s business operations, which are benefiting from the continued commercial development in strategic regions, recorded healthy average loan outstanding growth of 16%, partly justified by several subsidiaries entering the scope of consolidation.

Overheads were EUR 375.2 million, up 8% on the first half of 2017 (EUR 348.4 million). This rise is mainly attributable to investments to support the development of leasing activities, and to several subsidiaries entering the scope of consolidation.

Cost of risk stood at EUR 21.5 million, which is an extremely low level for outstandings in the region of EUR 30 billion.

Operating income amounted to EUR 296.4 million, up 2% on the first half of 2017 (EUR 289.5 million).

The share of the net profits of equity affiliates (i.e. the share of net profits of subsidiaries in which the Bank does not have a majority shareholding) stood at EUR 3.1 million, compared with EUR 16.8 million in the first half of 2017. This development is primarily attributable to a change in company consolidation accounting, which previously used the equity method and now uses the global integration method.

Group consolidated net profit for the first half of 2018 amounted to EUR 131.2 million, versus EUR 170.3 million in the first half of 2017. In an environment of persistently low interest rates, net income from the bank’s commercial activities is stable. However, the bank recorded an exceptional tax cost following a raised estimate of the value of BGL BNP Paribas’ participation in BNP Paribas Leasing Solutions S.A.

At 30 June 2018, the balance sheet total stood at EUR 54.2 billion, which is 9% higher than at 31 December 2017 and reflects the healthy development of business activities.

High solvency maintained

The bank’s solvency ratio was 23.5% (under Basel III rules), well above the regulatory minimum. With the Group’s share of regulatory capital amounting to EUR 6.1 billion, BGL BNP Paribas is well placed to back its clients’ projects and investments.

Highlights of the first half of 2018

Best Bank in Luxembourg for the third year in a row

Internationally renowned financial magazine Euromoney named BGL BNP Paribas “Best Bank in Luxembourg” for the third consecutive year in 2018.

When the awards were announced, Euromoney highlighted BGL BNP Paribas’ strong financial results as well as its solid growth in client deposits and loan outstanding, the healthy development of its leasing activities and the substantial increase in wealth management assets under management. Euromoney also highlighted the official launch of Microlux and the increase in private banking activity through the acquisition of ABN AMRO Bank (Luxembourg).

Furthermore, Euromoney named the BNP Paribas Group World’s Best Bank for Sustainable Finance.

Business expansion through the acquisition of ABN AMRO Bank (Luxembourg)

On 20 February 2018, BGL BNP Paribas and ABN AMRO Bank N.V. announced that they had signed an agreement concerning the acquisition, by BGL BNP Paribas, of all the outstanding shares in ABN AMRO Bank (Luxembourg) S.A. and of its fully owned subsidiary ABN AMRO Life S.A. Under this agreement, the insurance company is taken over by Cardif Lux Vie.

This acquisition seeks to reinforce the key positions that the BNP Paribas Group in Luxembourg holds in the private banking and insurance markets. The bank strives to play an active and responsible role in the consolidation process that is currently taking place in this sector. The proposed transaction has received the approval of the competent regulatory authorities and was completed on 3 September 2018.

Introduction of a new transport offering – Private Lease

In partnership with Arval, in early 2018 BGL BNP Paribas launched an innovative service, Private Lease, through which the bank offers long-term vehicle leasing to individuals living in Luxembourg. As an alternative to purchasing a car, this new product responds to growing demand among retail clients for a way to optimise their budget in line with the way they use their car. The new product enhances the bank’s traditional financing offering with attractive transport solutions and is a perfect example of the opportunities for innovation that arise within a large group.

Launch of LUXHUB, a joint initiative by several banks

In order to face the challenges and take advantage of the opportunities arising from the revised European Payment Services Directive (PSD2), BGL BNP Paribas, Banque et Caisse d’Epargne de l’Etat, Banque Raiffeisen and Post Luxembourg joined forces to launch LUXHUB in May 2018. This API (Application Programming Interface) connectivity platform is intended to make interconnection of the entire ecosystem of banks and third-party providers under PSD2 as easy as possible.

Creation of The Intrapreneur Zone (TIZ) to promote innovation

Launched in June as a joint initiative between the lux future lab and the bank’s HR department, The Intrapreneur Zone is a cross-functional initiative aiming primarily to promote innovation and entrepreneurship at the bank, to encourage collective success and to celebrate employees’ achievements. The programme will allow project owners to work in multi-disciplinary teams, to learn about new working methods and to apply them to new projects intended to promote innovation at the bank.

Triple environmental certification for the new buildings

When designing the new Kirchberg Banking Centre for the BNP Paribas Group in Luxembourg, the bank paid particularly close attention to ecologically responsible technologies, to minimising the consumption of energy and natural resources, and to the health, comfort and well-being of users. In terms of environmental policy, which was already firmly established at the company, this project represented a significant milestone. The bank was consequently especially proud of the triple environmental certification at European level awarded to the new buildings: exceptionnel from HQE (Haute Qualité Environnementale) in France, excellent from BREEAM (Building Research Establishment Environmental Assessment Method) in the United Kingdom and gold from DGNB (Deutsche Gesellschaft für Nachhaltiges Bauen) in Germany.

BGL BNP Paribas’ report for the half-year to 30 June 2018 is available in French at www.bgl.lu

About BGL BNP Paribas

BGL BNP Paribas (www.bgl.lu) is one of the largest banks in Luxembourg and part of the BNP Paribas Group. It offers an especially wide range of financial products and bancassurance solutions to individuals, professionals, businesses and private banking clients. At end 2017, the BNP Paribas Group employed around 3,700 people in Luxembourg, of which 2,379 at BGL BNP Paribas.

In 2018, the international magazine Euromoney named BGL BNP Paribas “Best Bank in Luxembourg” for the third year in a row.

BNP Paribas is a leading bank in Europe with an international reach. It has a presence in 73 countries, with more than 196,000 employees, including more than 149,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services (whose retail-banking networks and financial services are covered by Retail Banking & Services) and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients (individuals, community associations, entrepreneurs, SMEs, corporates and institutional clients) to realise their projects through solutions spanning financing, investment, savings and protection insurance. In Europe, the Group has four domestic markets (Belgium, France, Italy and Luxembourg) and BNP Paribas Personal Finance is the European leader in consumer lending.

BNP Paribas is rolling out its integrated retail-banking model in Mediterranean countries, in Turkey, in Eastern Europe and a large network in the western part of the United States. In its Corporate & Institutional Banking and International Financial Services activities, BNP Paribas also enjoys top positions in Europe, a strong presence in the Americas as well as a solid and fast-growing business in Asia-Pacific.

Press contacts:

Eliane Thines +352 42 42-62 64 eliane.thines@bgl.lu

Corinne Thill +352 42 42-30 85 corinne.thill@bgl.lu

As it has done every year since 2012, BGL BNP Paribas’ lux future lab – whose aim is to drive the country’s economic and social trends by promoting training and business skills – is offering a group of around 30 young people the chance to attend its Summer School.

The seventh annual Summer School, which has already been attended by almost 200 high school students since its launch, will be held from 16 to 27 July 2018. It targets high school students who are one or two years away from taking their final exams and are faced with some tough choices: What should I study? Which job do I want to do? Which skills do I need to achieve this? Thanks to its comprehensive programme, Summer School helps young people to answer these questions.

Over two weeks, students will meet innovative entrepreneurs, experienced craftspeople and professionals, all of whom have a flair for originality and a real passion for what they do. The goal is to give students the tools they need to take control of their destiny by offering them new opportunities and passing on a key value: passion!

Designed in collaboration with around 50 stakeholders from the business and academic worlds, the programme offers enriching opportunities to meet people from a variety of backgrounds, team-building activities, practical workshops and, last but not least, one-on-one support from a careers advisor.

Students can register for Summer School 2018 online until 20 May 2018, on the lux future lab website (http://www.luxfuturelab.lu/training/summer-school/). The registration procedure and conditions for participation are also available on the website.

During the design phase of the new Kirchberg Banking Centre for the BNP Paribas Group in Luxembourg with its oKsigen and eKinox buildings, the Group, in line with its approach as a socially responsible company, set itself the challenge of earning triple environmental certification at European level for the project: HQE (Haute Qualité Environnementale) in France, BREEAM (Building Research Establishment Environmental Assessment Method) in the United Kingdom and DGNB (Deutsche Gesellschaft für Nachhaltiges Bauen) in Germany. To that end, the bank paid particularly close attention to ecologically responsible technologies, minimising the consumption of energy and natural resources, as well as to the health, comfort and well-being of users.

Effective monitoring of energy and water consumption is guaranteed through high-performance regulation and technical management of the building. Air flow and lighting can be regulated depending on the actual usage of the spaces, and blinds can be raised and lowered as sunlight moves across the buildings’ facades.

To ensure ecologically responsible waste management, the Bank has implemented a careful waste sorting process that complies with the SuperDrecksKëscht® standard. Meanwhile, organic waste resulting from the preparation of meals in the company’s restaurants is collected and sent to a biogas production facility.

The ecological quality of the site and its biodiversity (vegetation suited to the climate and exposure, plant varieties that are predominantly non-allergenic and non-toxic) offer welcoming outdoor spaces for both users and local residents. Green roofs make up almost half of the roof area.

Marc Lenert, BGL BNP Paribas Management Board member, says: “We are particularly proud not only of achieving triple HQE, BREEAM and DGNB certification but also of the very high levels we received for each certificate, namely ‘exceptional’ for HQE, ‘excellent’ for BREEAM and ‘gold’ for DGNB. The oKsigen and eKinox buildings mark the beginning of a new phase in our environmental policy, which is already deeply rooted within our company. Earning these certificates inspires us to redouble our efforts in this regard by continuing to follow an integrated approach that combines environmental protection, minimal consumption of energy and natural resources, and protecting the health and comfort of users.”

Presentation of two cheques for a total value of € 10,000

Two cheques were recently presented to the “Association des Parents d’Enfants Mentalement Handicapés” (APEMH) at the BGL BNP Paribas head office. In replacement for end-of-year gifts, the Corporate Banking and Asset & Liability Management (Treasury) departments decided to support APEMH with a shared donation. In the presence of representatives from both departments, two cheques for a total value of €10,000 were presented to the heads of the organisation.

Founded by parents of children with mental disabilities, APEMH has worked tirelessly in support of young people with mental disabilities and their families since 1967. The charity’s primary goals are to defend the rights and interests of beneficiaries and to manage its range of resources and services. In the interests of meeting diverse needs and providing personalised support, APEMH offers a variety of solutions, resources, support systems and services. These may be on a one-off, recurring, regular or long-term basis, and include workplaces, training centers, day-care, accommodation and home visits. For APEMH professionals, the guiding principle is ensuring that beneficiaries enjoy the best possible quality of life.

This initiative shows once again how BGL BNP Paribas is making good on its commitment to be a responsible bank and illustrates its active participation in social and civic life.

About APEMH

APEMH (www.apemh.lu), founded in 1967, works to support people with mental disabilities. It offers a wide array of resources and services for people with mental disabilities and their families, regardless of age or life circumstances.

BGL BNP Paribas and ABN AMRO Bank N.V. announce that they have signed an agreement concerning the acquisition by BGL BNP Paribas of all the outstanding shares in ABN AMRO Bank (Luxembourg) S.A. and its fully owned subsidiary ABN AMRO Life S.A.

BGL BNP Paribas will transfer the activities of ABN AMRO Life S.A. to Cardif Lux Vie immediately following the acquisition. The proposed transaction, which is still subject to regulatory approval, should be finalized by the third quarter of 2018.

Pieter van Mierlo, CEO Private Banking of ABN AMRO Bank, said: “’We are a leading player in Private Banking in North-West Europe and are currently investing in, and further integrating, our activities across our core markets, to realise benefits of scale. The wealth management market is fast changing and consolidating further as scale becomes more important in order to invest in staff and systems needed to provide optimal services to our clients. In Luxembourg we do not see possibilities to increase to the scale necessary. We concluded that the transfer of our wealth management and insurance activities in Luxembourg to BGL BNP Paribas would be in the best interest of our clients.”

Carlo Thill, Country Head of BNP Paribas in Luxembourg, chairman of the Management Board of BGL BNP Paribas and chairman of the Board of Directors of Cardif Lux Vie, added: “This acquisition will reinforce the key positions that the BNP Paribas group in Luxembourg holds in the wealth management and in the insurance market. We want to play an active and responsible role in the consolidation process that is currently taking place in this sector. We assure the clients of ABN AMRO Bank (Luxembourg) and ABN AMRO Life that we are fully committed to ensuring a seamless transition and an irreproachable quality of service.”

Vincent Lecomte, co-CEO of BNP Paribas Wealth Management, stated: “We are delighted to bring to these wealth management clients our best-in-class customer experience, our extensive international network and our expertise both at Wealth Management and across our integrated Group. This acquisition is part of our strategy of growth and will enable us to strengthen our role as a growing player, not just in Luxembourg, but in the expanding world-wide wealth market where we are the largest wealth manager in the Eurozone and a leading global player world-wide with 364 billion euros of assets under management.”

BGL BNP Paribas (www.bgl.lu) is one of the largest banks in Luxembourg and part of the BNP Paribas Group. It offers an especially wide range of financial products and bancassurance solutions to individuals, professionals, wealth management clients and businesses. In 2017, the international magazine Euromoney named BGL BNP Paribas “Best Bank in Luxembourg” for the second year in a row.

About ABN AMRO

ABN AMRO is a Dutch bank for retail, corporate and private banking clients. We are a relationship-driven, knowledgeable and digitally savvy bank, active in Northwest Europe and with expertise in selected sectors globally. Headquartered in Amsterdam, ABN AMRO is located in 20 countries and employs around 20,000 people worldwide. Please visit us at www.abnamro.com.

About BNP Paribas Wealth Management

BNP Paribas Wealth Management is a leading global private bank and the largest private bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,800 professionals provide a private investor clientele with solutions for optimising and managing their assets. The bank has €364 billion worth of assets under management (as at 31 December 2017) and was awarded “Best Private Bank in Europe, in Asia and in the Western United States” in 2017.

About Cardif Lux Vie

Cardif Lux Vie is a Luxembourg insurance company that ranks among the major players in the market. Owned by a strong shareholder base (BNP Paribas Cardif, BGL BNP Paribas and Ageas), it benefits from a strong foothold both locally and internationally.

Cardif Lux Vie meets the specific needs of customers on several complementary markets: life insurance that caters for retail clients, collective insurance for businesses and international life insurance as a wealth structuring tool.

For private individuals and professionals in Luxembourg and the Greater Region, Cardif Lux Vie provides the bancassurance channels with global, integrated solutions with high added value. For high net worth international clients, the insurer operates under the freedom to provide services regime and has a large network of premium partners (Private Banks, financial institutions, brokers, etc.). It proposes customised and sustainable solutions using a comprehensive range of wealth structuring tools.

BNP Paribas is a leading bank in Europe with an international reach. It has a presence in 74 countries, with more than 190,000 employees, including more than 146,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services (whose retail-banking networks and financial services are covered by Retail Banking & Services) and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients (individuals, community associations, entrepreneurs, SMEs, corporates and institutional clients) to realise their projects through solutions spanning financing, investment, savings and protection insurance. In Europe, the Group has four domestic markets (Belgium, France, Italy and Luxembourg) and BNP Paribas Personal Finance is the leader in consumer lending. BNP Paribas is rolling out its integrated retail-banking model in Mediterranean countries, in Turkey, in Eastern Europe and a large network in the western part of the United States. In its Corporate & Institutional Banking and International Financial Services activities, BNP Paribas also enjoys top positions in Europe, a strong presence in the Americas as well as a solid and fast-growing business in Asia-Pacific.

Press contacts – BGL BNP Paribas

Eliane Thines +352 42 42-62 64 eliane.thines@bgl.lu

Corinne Thill +352 42 42-30 85 corinne.thill@bgl.lu

Press contact – Cardif Lux Vie

Emilie Sansonetti +352 26 214 5521 emilie.sansonetti@cardifluxvie.lu

Press contact – ABN AMRO Bank N.V.

Brigitte Seegers +31 630859 888 brigitte.seegers@nl.abnamro.com

Press contact – BNP Paribas Group

Servane Costrel de Corainville + 33 6 74 81 98 27 servane.costreldecorainville@bnpparibas.com

The BNP Paribas Group in Luxembourg has been awarded the prestigious “Top Employer Luxembourg 2018” certification for outstanding working conditions.

Every year the Top Employers Institute, a globally renowned independent organisation, certifies companies providing excellent working conditions that foster employees’ personal development. This year, following an assessment by an independent auditor, the BNP Paribas Group in Luxembourg once again received this distinction. The BNP Paribas Group was also certified at the national level in Italy, Belgium, Poland, Turkey, France and Spain (Cetelem), thus obtaining the “Top Employer Europe 2018” label.

In Luxembourg, particularly high marks were awarded for four of the audit criteria which even improved compared to 2017: workforce planning, talent strategy, learning and development, and career management.

Commenting, Patrick Gregorius, Head of Human Resources at the BNP Paribas Group in Luxembourg, said: “We are particularly proud to have been awarded the Top Employer Luxembourg certification once again, and even more so to have improved our results compared to last year. This seal of approval is a reward for our continuous efforts to create a positive working environment for our employees and thus ensure a high level of client satisfaction, as we firmly believe that happy employees make happy clients.”

Being the bank for a changing world means focusing on the future, readying ourselves for the challenges that lie ahead, and being a driver of innovation. That is why the BNP Paribas Group in Luxembourg seeks to provide employees with a superior working environment that is open and inspiring and that allows everybody to play their part in the process of change.

About Top Employers

This label, which was created in 1991, has developed the most widely recognised HR research and certification methodology in the world for identifying and certifying employers that provide their employees with the best working conditions. This certification rewards employers that provide their employees with optimal working conditions and HR practices in concrete terms. The attractiveness of HR policies is assessed on the basis of research carried out by the Top Employers Institute, which is present in 113 countries and has created a community of 1,382 Top Employers. The methodology used is adapted to each country and developed in close cooperation with a local panel of HR experts and other selected partners. All aspects of HR management – including in particular pay policy, working conditions, benefits, corporate culture, training and career development, career opportunities, etc. – are examined in detail.